It may have taken me a while to get through it all, but at this point in the shopping ban I was feeling good. I’d already determined a powerful WHY for completing the ban (my enormous and looming consumer debt), determined my values, and finally created lists for what I was, and wasn’t, allowed to shop for.

Revisiting the themes I’d set for the year, I was pleased with how well the shopping ban seemed to tie them all together.

ROOTS - I’d committed to being at home more in 2024, which made it easier not to make random purchases while traveling because I’d left something at home

LESS - The ban embodies my desire for fewer belongings, fewer obligations, and fewer things that made me feel trapped or weighed down (like all that debt).

INTUITION - Much of the beginning of the ban had included introspection and self-reflection, encouraging me to know myself better so that I could get to the core of what matters to me.

PERSIST - A shopping ban is, chiefly, a ban. It requires commitment, and as time passes, increased willingness to persist.

The efforts so far had felt powerful, informational, some of them even transformational; but as I read ahead to the next steps, I was wondering how I might be able to make them apply to my situation, specifically.

Flanders suggests that those adhering to a shopping ban take steps to unsubscribe from sales emails, and setup a shopping-ban-specific savings account; her words are below:

4. Unsubscribe from All Store/Coupon Newsletters

Now that you have your three lists of all the things you are and are not allowed to buy, it’s time to remove as many temptations as possible—starting with what gets delivered to your inbox. Whenever a newsletter comes in from a store or service that wants your money, hit unsubscribe. If you want to take this one step further, I suggest unfollowing all your favorite stores on social media. And if you want to take this one extra step further, I suggest also deleting all the bookmarks you have saved of things you wanted to buy “one day.” Out of sight, out of my mind, my friend.

- Cait Flanders in The Year of Less (2018), p. 175

5. Set Up a Shopping Ban Savings Account

No matter what your ultimate goal is, you are going to save money by not shopping. What you do with that money is up to you, but I suggest opening a new savings account (or renaming an existing one you don’t use) and making it your dedicated Shopping Ban Savings Account. How much money you decide to put in it each month is up to you. I started by depositing $100 per month, because I knew I was saving that by not buying take-out coffee anymore. Another idea is to transfer any money you stop yourself from spending by not giving in to an impulse purchase. Finally, you could also deposit any money you make by selling things you decluttered.

If you want an extra reminder to not spend money, put a sticky note around each of the debit and credit cards in your wallet with a reminder that you’re on a shopping ban. Write something on it like: “Do you really need it?” or “Is it on your shopping list?”

- Cait Flanders in The Year of Less (2018), pp. 175-76

Shopping isn’t a big hobby of mine, and I am a fanatic about having an email inbox that is tolerable to look at (inbox zero changed my life). I unsubscribe from ANY unwanted email the first time I see it, and I am liberal with the “junk” and “block” buttons if my “unsubscribe” is not heeded in a timely manner. I don’t follow stores on socials, and in sum I have already taken great steps to disentangle myself from direct advertising to the extent possible.

I wanted to take action on the fourth suggestion, but I didn’t quite know where I could take it. What stood out to me in the text was the words temptations. I believe this is at the heart of the unsubscribe task—to get as many temptations as possible out of the way in the beginning, so they don’t become roadblocks down the road when it gets harder to adhere to the ban.

Instinctually, I knew this meant I would be giving up Target.

As a Minimalist, as someone who engages with anti-capitalist theory, as someone who is willingly taking on a shopping ban, I am maybe embarrassed to admit that I feel the same magnetic pull to Target as any millennial girlypop. I think about it unprovoked, I desire to be there, I have made entire dates out of getting coffee and walking around Target.

As I write this, I imagine being in a Target, and I actually feel a little pinprick of excitement. Whatever it is they lace things with to make us all addicted to shopping, Target has the best recipe around.

It’s not even buying things that excites me, it is simply being in Target, and I think that’s the insidiousness of it. Even though I don’t need anything at all, I am always eager and excited for a Target run, which means I am in the store more often than I would be in a different store, and more often making impulse and unnecessary purchases. Walmart could NEVER.

In support of the ban, it would become my intention to not set foot in a Target this year. I shuddered a little as I wrote that, which solidifies it’s importance.

Flanders’ other suggestion, to open a shopping-ban-specific savings account, I found also did not seem to apply well to my situation. For one thing, my day job is 100% commission with seasonal slumps and rushes. As a result, I don’t get a paycheck every two weeks, and I don’t ever get the same amount of money or get paid on any predictable schedule. For this reason, most approaches to budgeting which focus on monthly income are entirely useless for my money management.

When I don’t spend money on shopping, I am not saving so much as I am stoppering my debt.

It wouldn’t benefit me much to open a savings account, because in all likelihood, it isn’t cash that will be produced by my shopping ban, but a reduction in new debt acquired. Again I read the paragraph the author wrote, and I felt that the core of it was to be able to visualize the impact of making different shopping choices (by being able to see the savings in an account).

For my part, I’d be able to visualize the impact I was making if I tracked the balances of my credit cards, meticulously, and compared them to spending the previous year, when I was not on a shopping ban.

In this way, I’d not only be able to measure the effect of the shopping ban on my debt, but also become more intimately acquainted with the nature of my spending by having a control set—credit card statements from 2023.

Additionally, I’d be able to put any disposable income I did come across toward my debt with the intention of reducing my overall debt to half it’s current total by the end of 2025. Of course I want to be debt free, but first I want to be paying substantially less each month in interest and credit card minimums; so I’d be starting with the first half.

When I reviewed my spending in 2023 compared to 2024, it reminded me of the mindset I’d had in 2023. Even though I knew that my debt was becoming a problem, I didn’t realize until January 2023 that my life was becoming unsustainable.

My girlfriend and I agreed to do “no spend Jan” for the first month of 2023, a more extreme version of the shopping ban where spending any money on take out food or coffee is forbidden, and no luxury or experience purchases are allowable. At the end of the month, we tallied up our expenses to establish a baseline—these were our bare bones expenditures with no excess. When I looked at those numbers, I knew I needed to make some serious changes, and quickly.

By March of that year I had bought my little green house, two hours away from anyone or anything I knew. Moving out into rural Colorado to live on the Great Plains was one of the bigger sacrifices I made to begin reigning in my debt, but it would not be the last. As a result, even my 2023 spending wouldn’t show the whole picture, because I’d already gotten it in my mind to make different choices about how I’d spend money.

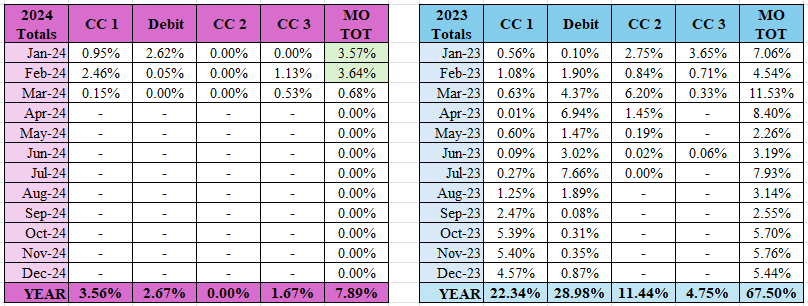

Still, committing to a longer term shopping ban had already proven to be an effective way to curb spending. The tables below show my monthly spending as a percentage of my annual income. In 2023, I spent a whopping 67.5% of my income. This doesn’t include any bills, mortgages, credit card payments, or credit card interest; it does include groceries and home goods, shopping, airfare, hotels, gas, and fees (like foreign transaction and overdraft fees).

Gentle reader, I will let you know plainly that the entirety of the rest of my expenses is a lot more than 32.5% of my annual income; this means that I finished 2023 squarely in the red.

As I write this we are 18% of the way through 2024 and I have spent 7.89% of my annual income on the categories listed above. If I continue spending in the way I have been, I’ll be on track to spend around 44% of my annual income this year, which is a tremendous 23% reduction.

Of the spending so far in 2024, exactly $324.24 of it has been on “stuff,” and that’s all been on approved purchases like replacing broken items. It currently represents an average of about $160/month in spending on “stuff,” and I expect that average to drop steeply over the Summer when I will be home with nothing to do but refrain from shopping.

Here’s to a year of LESS, and to being able to see my hard work pay off as the year progresses.

Photo by The Nix Company on Unsplash